The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

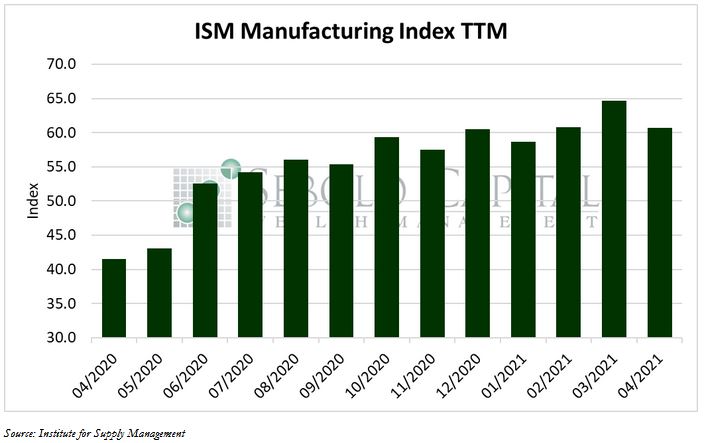

In April, the Manufacturing PMI declined by 4.0 percentage points to a reading of 60.7. Since the index remains above 50.0, this marks the eleventh consecutive month of expansion for the manufacturing sector and the economy as a whole. All of the six major industries in the survey reported moderate to strong growth last month.

The Manufacturing Index is comprised of several equally weighted subindexes that measure conditions in the industry. Nearly every index declined last month, the only exception being the ones measuring prices, new export orders, and order backlog. The production index fell the most, decreasing by 5.6 points. Both the employment and the imports indices declined by 4.5 points each. The index that measures new orders fell by 3.7 points in April. Customers’ inventories continued to decline and currently sit at historically low levels, with the corresponding index sliding by 1.5 points to 28.4. Low customer inventories are usually seen as an indicator of future growth and demand.

While the manufacturing industry continues to expand at an above-average rate, it continues to face a number of challenges that could hinder its growth potential. In particular, respondents mentioned that the ongoing semiconductor shortage is having a significant impact on their operations and costs. Prices appear to be rising across the board, a sign that inflationary pressure continued to build up in the economy. For the past four months, every industry in the survey has reported having to pay higher prices for raw materials. On a more positive note, the employment situation in the industry appears to be improving. Low inventories, rising order backlogs, and strong new-order levels indicate that demand for labor in the industry will continue to increase.

May 3, 2021