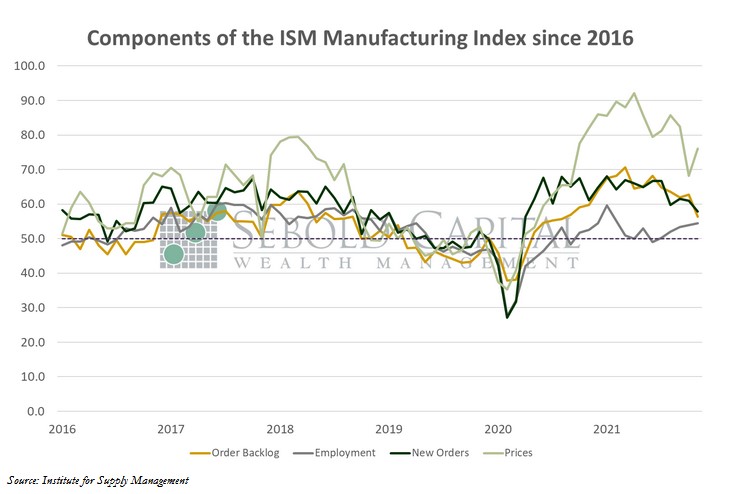

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

In April, the Manufacturing PMI declined by 1.7 percentage points to a level of 55.4—the lowest since September 2020. The reading came in below market expectations, which hovered at around 57.6. Despite the decline in the index, this marks the 23rd consecutive month of growth for the manufacturing sector and for the economy as a whole since the index remains above 50 points. Five of the six major manufacturing industries that make up the report registered moderate to strong growth last month, and of the eighteen individual industries included, seventeen reported expansion. The only industry reporting a contraction was Petroleum and Coal Products.

The Manufacturing Index is comprised of several equally weighted subindexes that measure conditions in the industry. The sector appears to remain in a demand-driven, supply-chain-constrained environment. While it performed well in April, although demand saw slower month-over-month growth due likely to high material prices and extended lead times. Although both sub-indices remain elevated, they did ease slightly last month, perhaps indicating that conditions could improve over the next several months. However, the shutdowns in China are causing concerns among respondents for late second quarter and early third quarter. Disruptions in the supply of goods and raw materials coming from China could easily create even more havoc in supply chains and further delay any sort of return to normalcy from a supply-side perspective. On the employment front, panelists reported a marginal improvement in their ability to recruit and hire, although high labor turnover continues to create staffing issues. Prices continued to increase, with the corresponding sub-index sitting at a historically high level of 84.6, although it is an improvement over March’s 87.1 print.

May 3, 2022