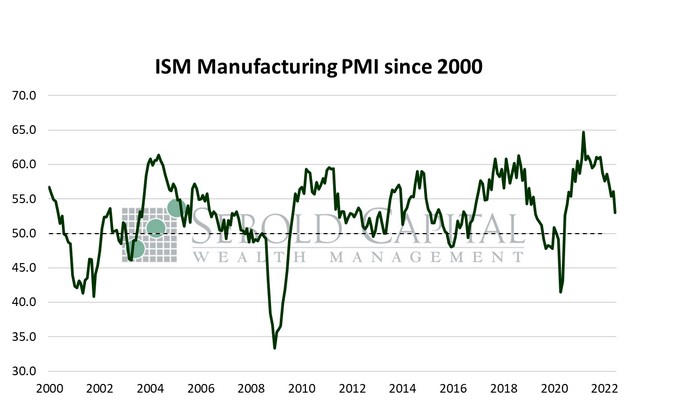

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

In June, the Manufacturing PMI declined by 3.1 percentage points to a level of 53.0—the lowest since June 2020. The reading came in below market forecasts of 55.0. Despite the decline in the index, this marks the 25th consecutive month of expansion for the manufacturing sector and for the economy as a whole as the index remains above 50 points. All of the six major manufacturing industries reported strong to moderate growth last month, and of the eighteen individual industries included, fifteen saw growth. The three industries that reported a contraction were Paper Products, Wood Products, and Furniture Products.

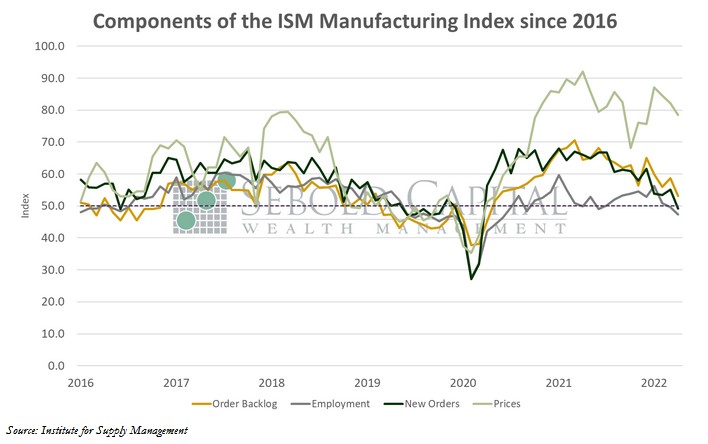

The Manufacturing Index is comprised of several equally weighted subindexes that measure conditions in the industry. Demand appears to be somewhat softening, likely held back by persistent supply chain constraints. The sub-index that measures new orders declined into contraction territory, and the backlog of existing orders remained elevated. Employment conditions contracted for the second consecutive month, with the corresponding sub-index falling to 47.3, its lowest reading since August 2020. Prices, though still elevated, expanded at a slightly slower pace in June. The sub-index that measures prices posted its fourth consecutive monthly decline, signaling that perhaps the worst is over for input prices in the manufacturing industry. That said, inputs themselves continue to constrain production, though to a lesser extent compared to the previous month. The inventories sub-index, which had fallen into contraction territory in May, rose above that threshold to 50.7. Despite the mixed data, panelists largely remained cautiously optimistic about demand conditions. Supply chain and pricing issues remain their top concern, and labor turnover remains a challenge to properly staffing firms. The industry continues to face challenges, although it appears that it is settling into a state more or less resembling pre-pandemic conditions. As supply chains clear up and inflation—hopefully—beings to ease, the industry should be able to return to a more stable state.

July 1, 2022