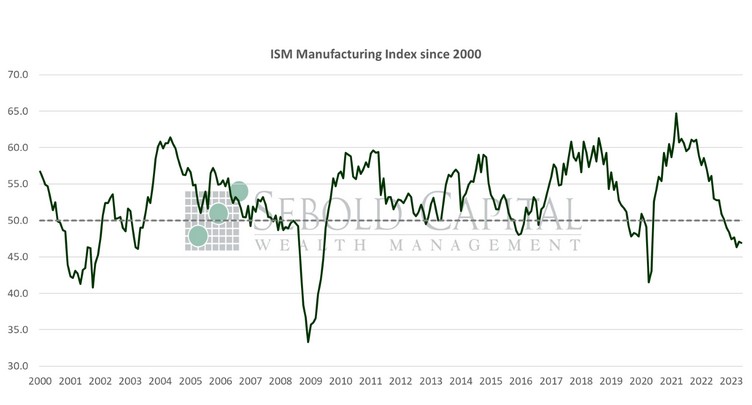

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

The Manufacturing PMI (formerly the ISM Manufacturing Index) is derived from a survey of purchasing managers and their outlook on overall conditions by looking at factors such as orders for durable goods, industrial production, and hiring. It gives a general direction rather than the specific strength of the factory sector and manufacturing activity in the U.S. A reading above 50 is an indicator that the manufacturing sector is growing while a reading below 50 indicates a contraction.

In May, the Manufacturing PMI declined by 0.2 percentage points to a level of 46.9. This was just short of expectations of 47.0, representing a contraction in manufacturing activity. The print represents the sixth consecutive month of contraction. Production, employment, and new export orders were the only components to show growth in May. The index continues to demonstrate signs of weakness. Of the six biggest manufacturing industries, transportation equipment was the only to grow in May.

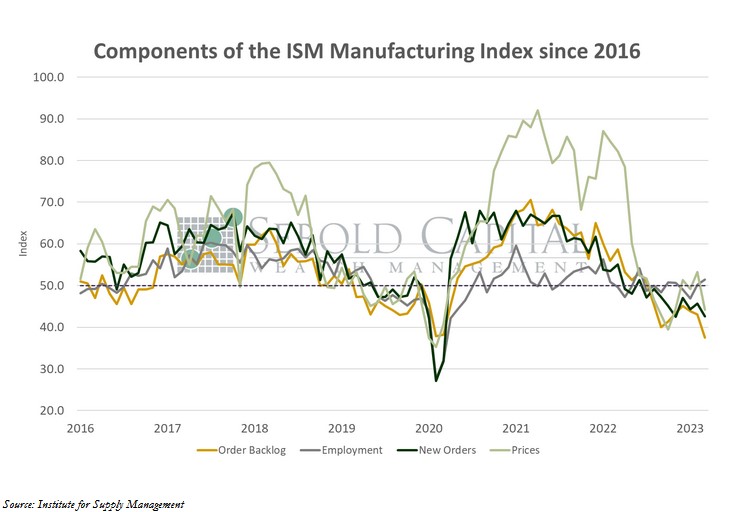

The Manufacturing Index is comprised of several equally weighted subindexes that measure conditions in the industry. Demand eased once again, with the index representing New Orders contracting at a faster rate. Customers’ inventories remain high, a negative for future production; the backlog of orders dropped to a level not seen since 2008.

The employment index expanded for the second month after two months of contraction, with mixed responses from panelists regarding hiring sentiment. The production index returned to expansion territory. Measures of production inputs indicate the ability to accommodate future increases in demand, indicating that supply chains are recovering.

The index that measures prices saw a significant nine-point decline, falling into contraction territory again; extrapolating that to expectations for future inflation, it serves as yet another disinflationary signal. Overall, conditions in the manufacturing industry continue to soften, giving some leeway for the Federal Reserve to slow, and perhaps pause, it’s tightening cycle.

June 1, 2023