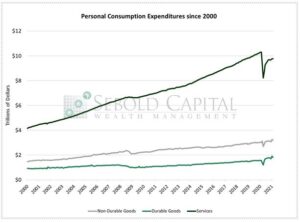

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. We see where consumers are spending their dollars, whether it be durable and nondurable goods, or on services. Changes in the personal income level dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. We see where consumers are spending their dollars, whether it be durable and nondurable goods, or on services. Changes in the personal income level dictate consumer spending.

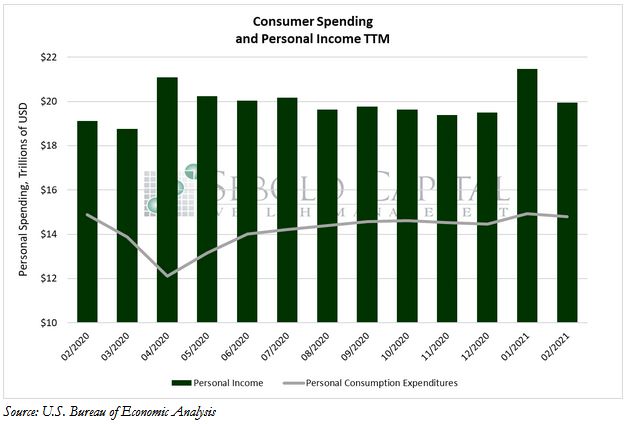

In February, personal consumption declined by 1.0% to $14.79 trillion, while personal income fell by 7.07% to $19.9 trillion. Personal consumption excluding food and energy declined by 1.2% to $13.06 million. Purchases of durable goods fell by 4.72% to $1.82 trillion, and consumption of non-durable goods decreased by 2.01% to $3.20 trillion. However, consumption of services rose very slightly last month, growing by 0.07% to $9.77 trillion.

Both personal spending and income declined last month after the initial impact of the second round of stimulus checks wore off. Consumer spending had surged in January as the Federal Government distributed $600 checks to many individuals. After that additional money was spent, consumers returned to a more normal level of spending. Likewise, the severe winter weather that many parts of the country experienced in February likely kept some consumers from going out and spending, leading to a decline. However, now that a third round of stimulus checks—this time for $1,400—is being distributed, consumption will likely surge in the near term once again. Similar spikes in consumption were observed shortly after the first two rounds of checks went out, so it is relatively safe to assume that they will have a similar effect this time around.

March 26, 2021