Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. We see where consumers are spending their dollars, whether it be durable and nondurable goods, or on services. Changes in the personal income level dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. We see where consumers are spending their dollars, whether it be durable and nondurable goods, or on services. Changes in the personal income level dictate consumer spending.

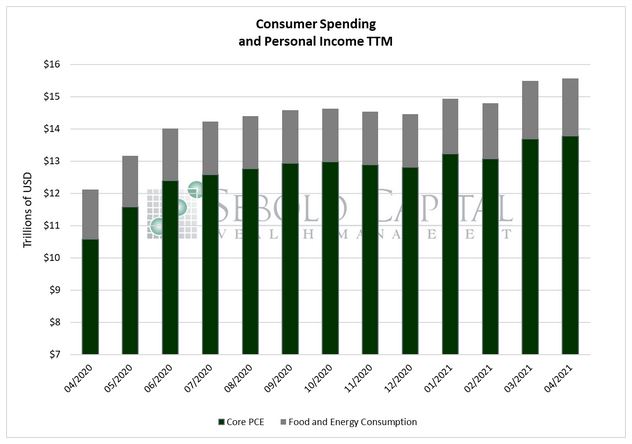

In April, personal consumption rose by 0.52% to $15.56 trillion, while personal income fell by 13.4% to $21.2 trillion. Personal consumption excluding food and energy increased by 0.7% to $13.8 trillion. Purchases of durable goods increased by 0.5% to $2.1 trillion, while consumption of non-durable goods declined by 1.3% to $3.35 trillion. Consumer spending on services increased by 1.13% to $10.1 trillion and has nearly returned to pre-pandemic levels.

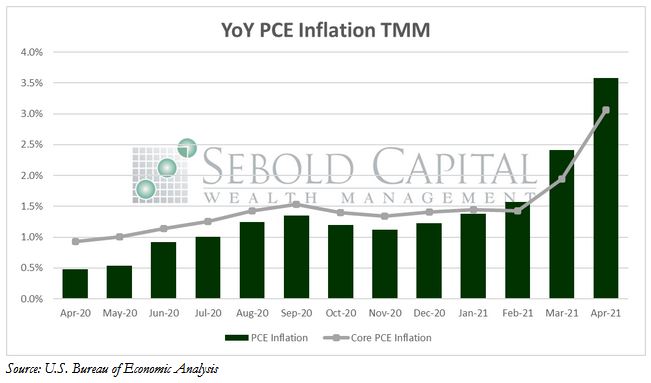

Personal spending remained nearly unchanged last month, but personal income declined as the effects of the third round of stimulus checks largely wore off. Consumption now seems to be shifting from goods and towards services, as these are now able to operate close to full capacity. Prices continued to rise in April as inflationary pressure continues to build within the economy. Headline PCE inflation surged to 3.6% from 2.4%, while Core PCE inflation rose to 3.1% from 1.9%. This was the largest YoY rise in PCE inflation since mid-2008, and the single largest increase in Core PCE inflation since 1992. The latter serves as the Fed’s preferred inflation gauge, and even though it now sits firmly above its 2% target, there is still no indication of a hike in interest rates or a taper to the asset-purchasing program in the near future. Since there are essentially no measures keeping prices in check, and consumers are itching to spend the current surplus of money (the personal savings rate declined from 27.7% to 14.9% last month), prices will likely continue to rise and the ongoing shortages will probably worsen in the near term—at least until a change in policy is enacted.

May 28, 2021