Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

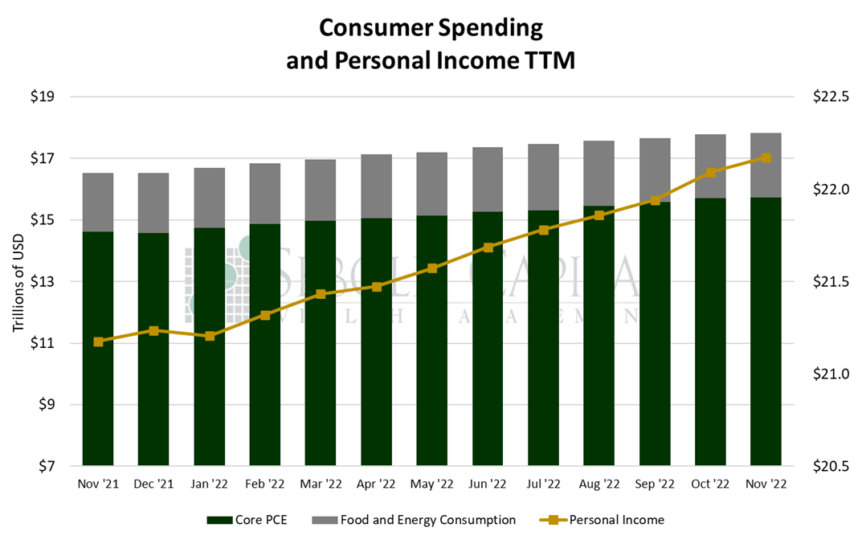

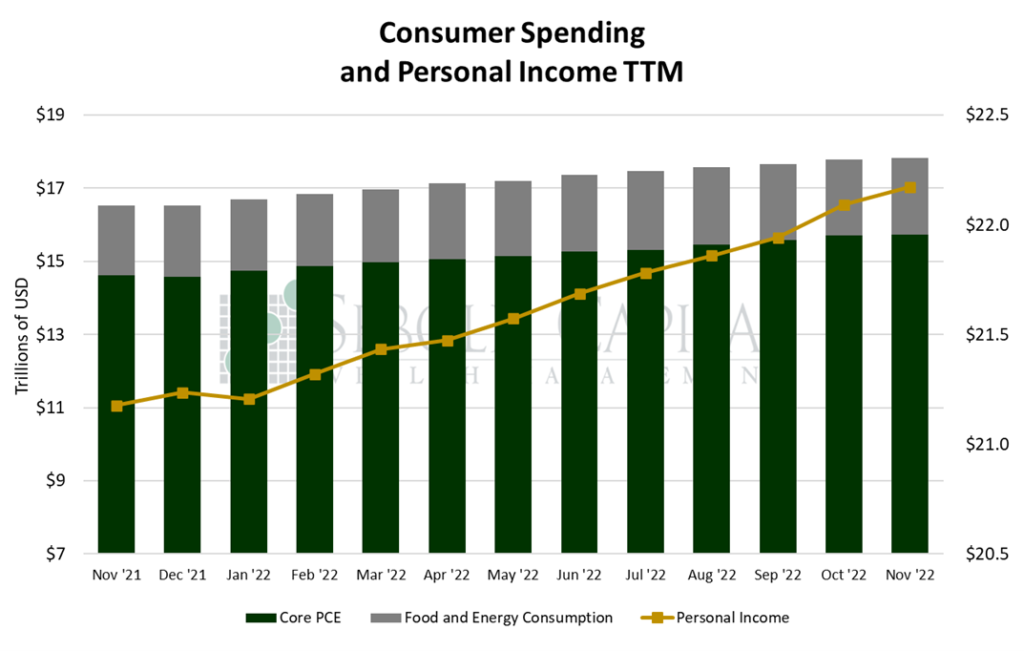

In November, personal consumption rose by 0.1% to a seasonally adjusted annual rate of $17.83 trillion, while personal income increased by 0.4% to $22.17 trillion. Excluding food and energy, consumption rose by 0.2% to $15.73 trillion. Consumer spending on services rose by 0.67% to $11.82 trillion. However, spending on durable goods plunged -2.29% to $2.18 trillion and purchases of non-durable goods fell -0.21% to $3.82 trillion.

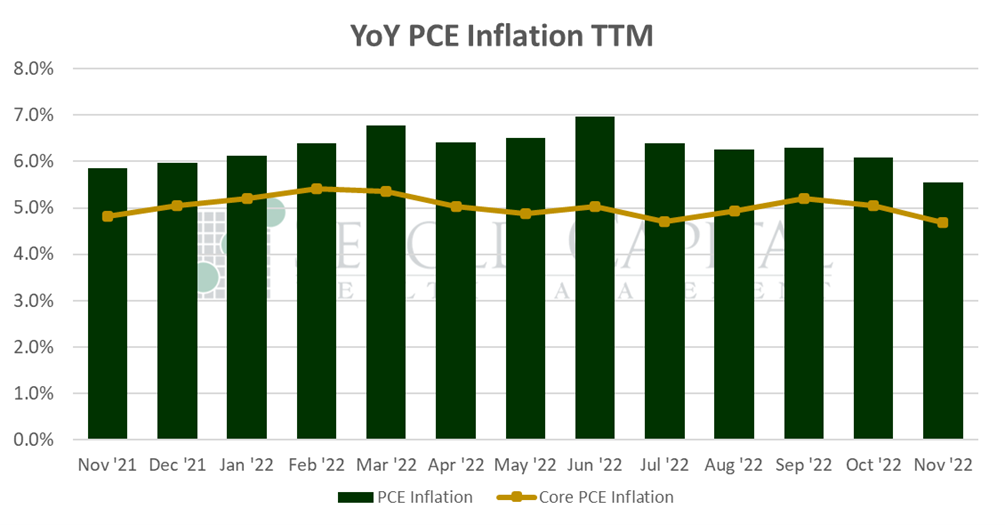

Consumer spending rose modestly last month, largely matching market expectations. However, both headline and core consumption were revised higher from the previous month, making the net increase marginally higher. Spending was driven mainly by services, as consumption of both durable and non-durable goods took a hit. Prices rose at a slower pace last month as well, with headline prices climbing 0.1% in November and core prices increasing by 0.2%. On an annual basis, prices rose by 5.5%, down from 6.1% in October. The main contributors to the headline were housing and utilities, followed by food and beverage consumption. All major contributors slowed down relative to the previous month.

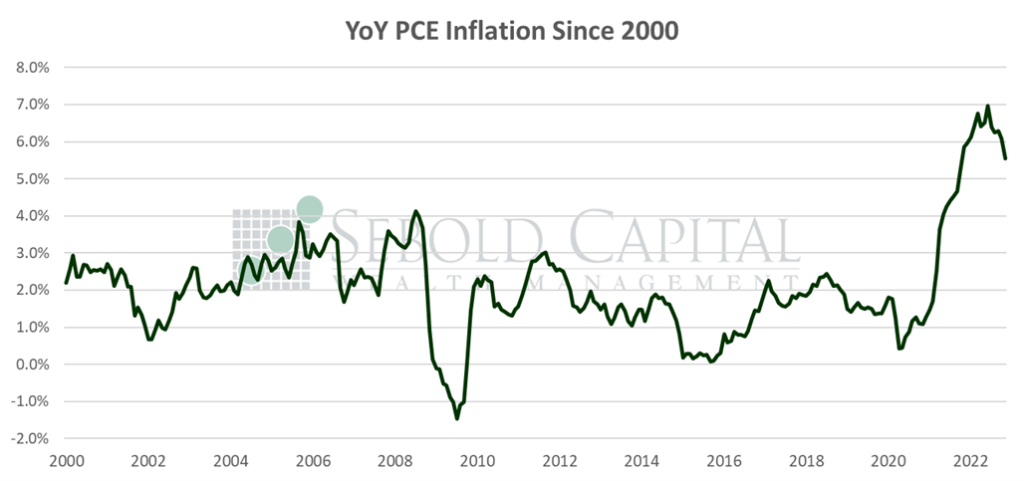

The core PCE price index, the Fed’s preferred inflation indicator, saw its annual print decline from 5.0% to 4.7%. Interestingly, that is already below the Fed’s year-end forecast, albeit by a mere 0.1%; the Fed projected that core inflation at the end of 2022 would be 4.8%, and if the current trend holds, the last print of the year will be lower than that. That would also call into question their recently updated inflation forecast for the end of 2023. Their current expectation is 3.5% core inflation by the end of next year. If inflation continues to decline at its current pace, and the fact that M2 growth is now flat suggests it will, then the Fed’s interest rate narrative of “higher for longer” makes little sense. However, a pivot remains an unlikely possibility for now.