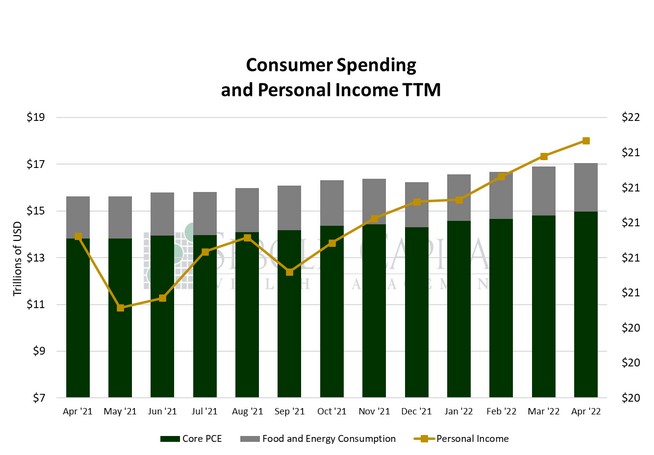

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

In April, personal consumption rose by 0.90% to $17.06 trillion, while personal income rose by 0.42% to $21.47 trillion. Excluding food and energy, consumption rose by 1.15% to $14.98 trillion. Spending on durable goods increased by 2.40% to $2.18, while spending on nondurable goods declined by -0.06% to $3.75 trillion. Spending on services rose by 0.94% to $11.13 trillion.

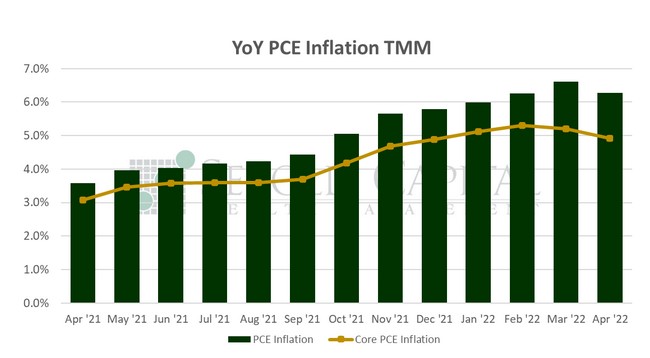

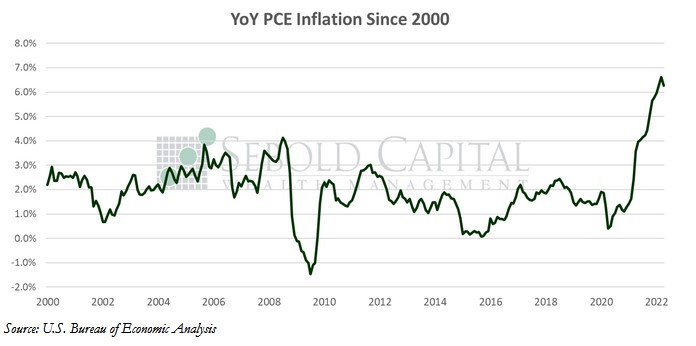

Consumer spending rose in April, although at a somewhat slower rate than the previous month. However, when excluding purchases of food and energy, spending rose at the fastest pace in four months. That said, the savings rate fell to 4.4%, its lowest value in fourteen years, indicating that consumers may be tapping into their saving to offset higher prices. On the topic of prices, the PCE price index rose by 0.2% last month, compared to 0.9% in March. Core prices advanced 0.3%, the same as the previous month. Both came in slightly below market expectations. The annual PCE inflation rate declined for the first time in seventeen months, falling from 6.6% to 6.3%, perhaps suggesting that the elusive inflation peak has finally been reached. The core inflation rate, the Fed’s preferred inflation indicator, also declined, from 5.2% to 4.9%.

Now, this does not mean that prices have eased, it merely means that the rate at which they were increasing has slowed down a bit; prices are still rising. Increases in the price of goods were fairly broad across all categories, except for gasoline and other energy products. The latter helped moderate the price index last month. The price of gasoline dipped briefly around mid-April, although it has been on the rise since then, meaning it might be too early to draw any definitive conclusions about inflation.

May 27, 2022