Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

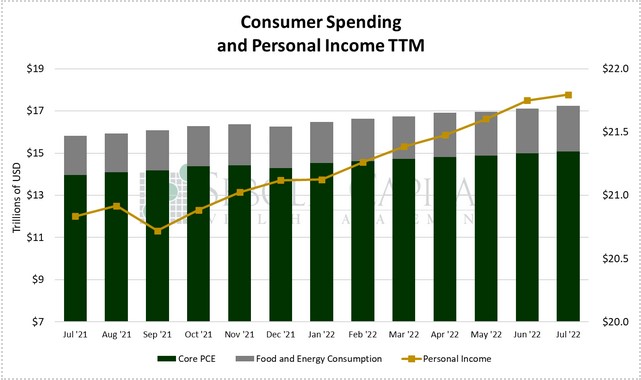

In July, personal consumption rose by 0.14% to $17.18 trillion, while personal income increased by 0.22% to $21.8 trillion. Excluding food and energy, consumption rose by 0.48% to $15.07 trillion. Spending on durable goods increased by 1.28% to $2.16 trillion, while spending on non-durable goods declined by 0.96% to $3.8 trillion. Spending on services was 0.30% higher last month, coming in at $11.22 trillion.

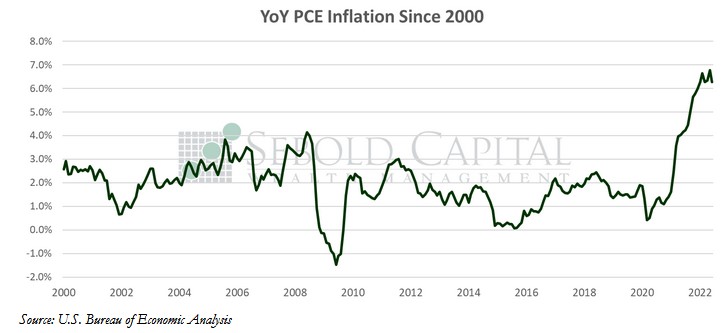

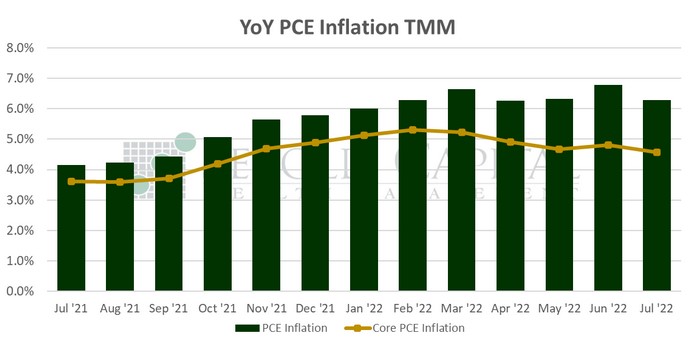

Consumer spending remained largely unchanged last month, increasing at the slowest pace since December. The number came in below the consensus, which hovered at 0.4%. June’s print was also revised from 1.1% to 0.99%. However, costs eased in July, coinciding with lower energy prices. On a monthly basis, the PCE price index declined by 0.1%, its first negative print since April 2020. The year-over-year print declined from 6.8% to 6.3%. The core index, which excludes prices for food and energy and also serves as the Fed’s preferred measure of inflation, rose by 0.1% last month. On an annual basis, core prices rose by 4.6%—which is admittedly more than double the Fed’s target of 2% but closer to it than the previous month’s 4.8% advance. However, despite the apparent relief from inflation, it is unlikely that the Fed will pivot from their accelerated tightening cycle. While some had hoped that improving inflation data would prompt the Fed to raise rates more slowly, recent comments by Fed Chairman Powell indicated that it will take more than a single month’s worth of data for the FOMC to feel confident that inflation has peaked. That means we will likely continue to see rate hikes of at least 50 basis points, if not 75, for the next few meetings.

August 26, 2022