Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

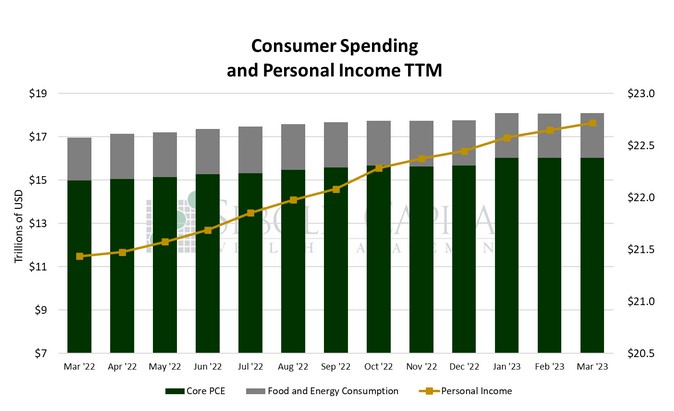

In March, personal consumption rose by 0.05% to a seasonally adjusted annual rate of $18.1 trillion, while personal income increased 0.3% to $22.72 trillion. Excluding food and energy, consumption advanced 0.04% to $16.02 trillion. Consumer spending on services rose 0.37% to $12.05 trillion, while consumption of both durable and non-durable goods declined. Spending on durable goods fell by 0.89% to $2.24 trillion and purchases of non-durable goods declined 0.44% to $3.82 trillion.

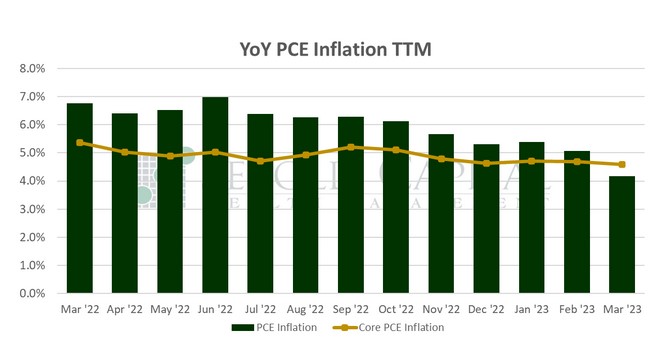

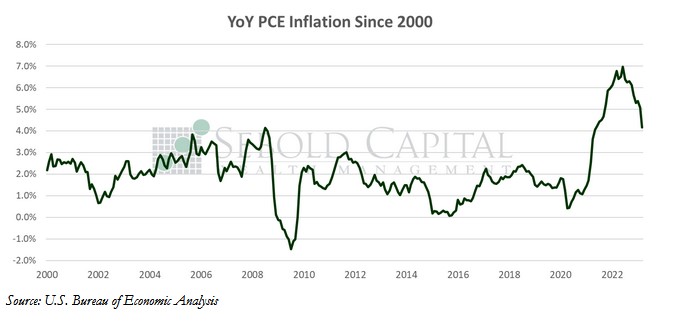

Consumer spending remained nearly unchanged last month, although it did manage to beat expectations of a small decline. The forecast called for a retreat of 0.2%. Inflation, as measured by the PCE price index, declined from 5.1% to 4.2%, its lowest value since May 2021. The decline was driven by lower inflation in food and energy prices. However, the Core PCE price index-which usually serves as the Fed’s preferred inflation measurement-remained largely unchanged at 4.6%, only declining marginally due to February’s print being upwardly revised to 4.7%. That said, month-over-month data reveals a more encouraging trend, as March’s 0.28% increase was the smallest in four months. Inflation remains above the Fed’s target, although it appears to be moving in the right direction. As the Fed considers its next move from a monetary policy perspective in the next few days, such trends should certainly be taken into account, as well as the fact that monetary policy operated with a long and variable lag. There is very little doubt that the Fed will hike the rate to 5.125% at its upcoming meeting. Additional rate hikes, however, look to be on pause for at least one meeting and data continue to support a slowing inflation rate.

April 29, 2023