Consumer spending, measured by Personal Consumption Expenditures (PCE), makes up approximately two-thirds of the economy and is a direct measure of purchasing activity. PCE is a reliable indication of inflation because it is calculated from data acquired directly from the GDP report and businesses. It shows us where consumers are spending their dollars, whether it be durable and non-durable goods, or on services. Changes in the personal income level usually dictate consumer spending.

In May, personal consumption rose by 0.10% to a seasonally adjusted annual rate of $18.27 trillion, while personal income increased 0.40% to $22.75 trillion. Excluding food and energy, consumption increased 0.30% to $16.23 trillion. Consumer spending on services rose by 0.43% to $12.21 trillion. However, spending on non-durable goods fell by 0.32% to $3.82 trillion and purchases of durable goods dropped by 0.93% to $2.23 trillion.

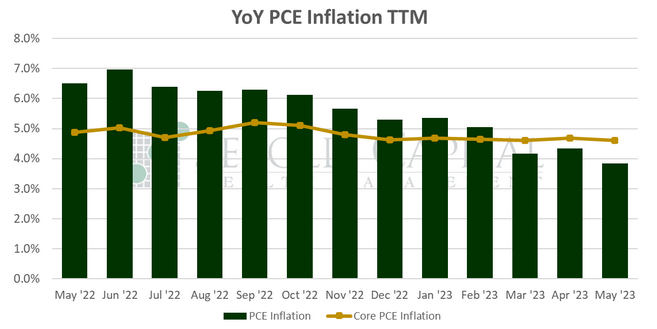

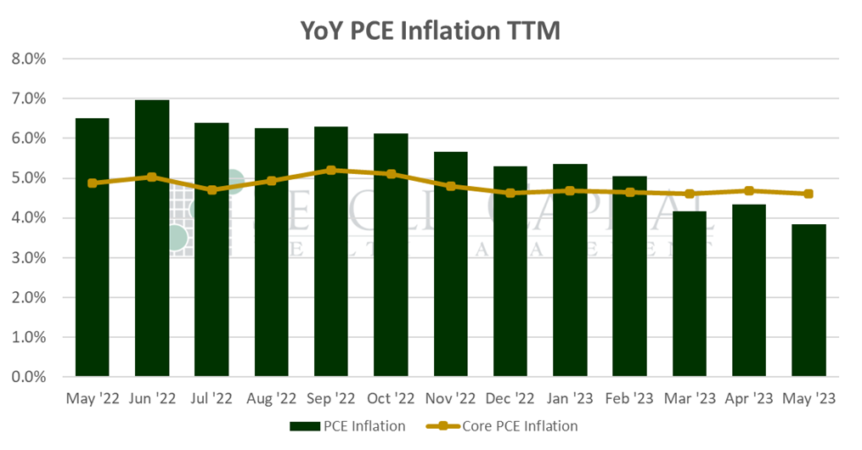

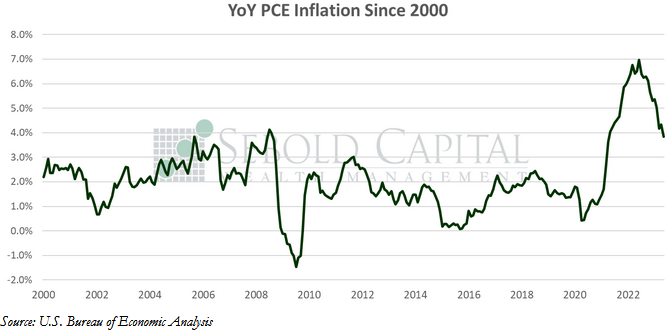

Consumer spending rose modestly last month, coming in below the expected 0.4% increase. The print was moderated primarily by lower food and energy prices, as core spending matched expectations of a 0.3% advance. The story was evident in the inflation data as well; inflation, as measured by the PCE price index, declined from a downwardly revised 4.3% to 3.8%. This is the first time PCE inflation has had a three-handle since April 2021. Core inflation, however, remained relatively unchanged at 4.6% (down from 4.7%). Aside from the volatile food and energy categories, it appears that some price pressures remain, although it appears that we are still headed in the right direction. On a monthly basis, Core PCE inflation has been gradually moderating, which will likely help the annual print—which serves as the Federal Reserve’s preferred inflation measure—return to its 2% target eventually. How long it takes to get there is a point of contention for the Fed. Although the FOMC did not raise rates at its last meeting, officials left the possibility of more hikes on the table. If Core PCE does not come down fast enough for their liking, they may opt for further rate hikes even if the rest of the data does not support that course of action. There will not be another PCE print before the next FOMC meeting, meaning that May’s report will weigh heavily on their monetary policy decisions.