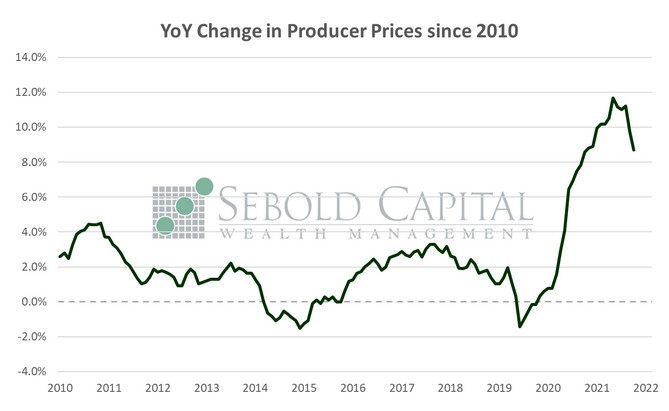

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand/intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand/intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

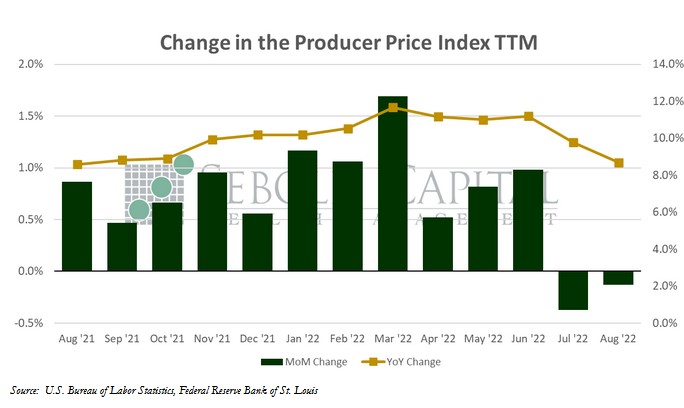

In August, the PPI declined by 0.1% to a level of 139.7, matching market expectations. However, core PPI, which excludes prices for food and energy and is therefore considered to be less volatile, rose by 0.4% to a level of 136.4. That was slightly above market expectations of a 0.3% advance. July’s print for both headline and core PPI was upwardly revised, although the former remained negative. Year-over-year producer inflation declined from 9.8% to 8.7%, while the core inflation rate fell from 7.7% to 7.3%.

Producer prices fell moderately last month, led primarily by lower energy prices. The index that measures prices for final demand energy declined 6%, and was responsible for most of the substantial 1.2% pullback in the annual rate of producer inflation. However, core prices edged higher mirroring the CPI report; that said, their advance was more moderate relative to core consumer prices. Prices for goods declined 1.2% in August, while the cost of services increased by 0.4%. One area the report differs notably from the CPI is food prices; while prices consumers pay for food rose 0.8% last month, producer prices remained unchanged. This bodes well for consumer prices since gains in those have been offsetting declines in energy prices for the past few reports.

Falling energy prices, in particular lower fuel costs (wholesale gasoline prices fell by 12.7%), will likely help to further moderate consumer and producer prices. However, the Fed is unlikely to look at today’s report and decide to opt for a lower rate hike at its next meeting. The market is currently pricing in yet another 75-basis-point hike with a 76.0% probability. A full 1% hike, which—as far as the market was concerned—was off the table completely just a week ago, now has a 24% implied probability of happening. Even if inflation continues to ease relatively quickly, the Fed is unlikely to pivot too quickly—it appears they do not want to repeat their previous mistake of underestimating inflation.

September 14, 2022