The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

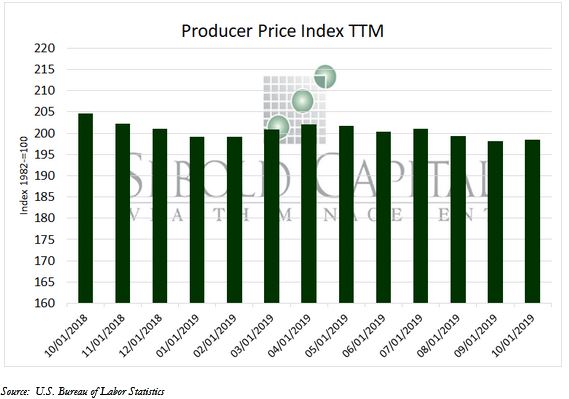

In September, PPI increased 0.4% to 198.5, a 1.8% increase from one year ago. Core PPI, which excludes volatile categories like food and energy, is up only 1.1% from one year ago.

The sharp monthly PPI increase can be largely attributed to the 7.3% increase in gas prices. Therefore, we do not see any significant upward pricing pressures coming from producers. This would indicate stable pricing moving forward.

11/14/2019