The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

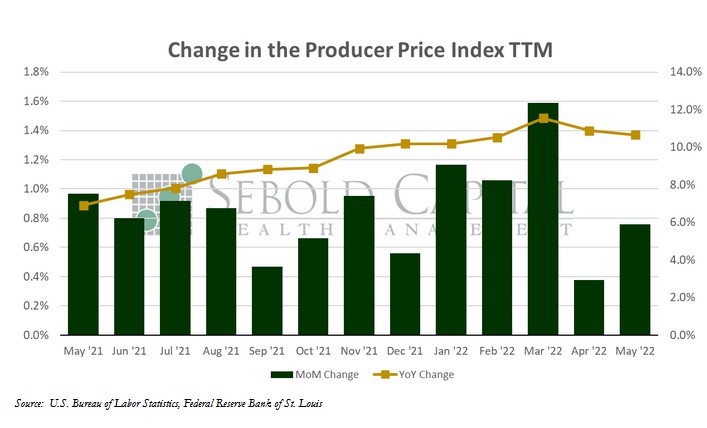

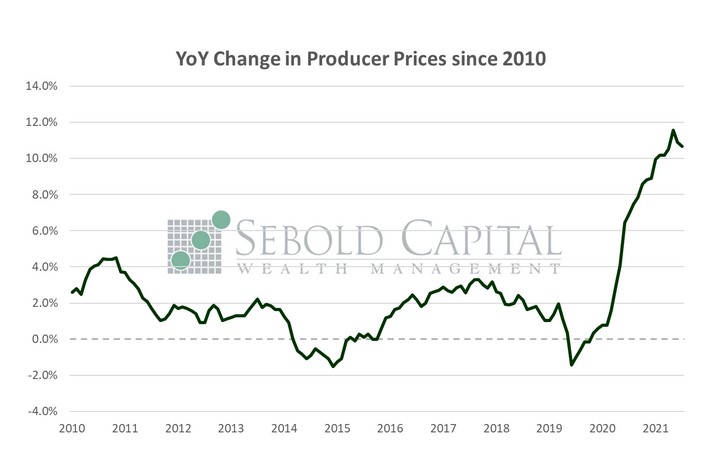

In May, the PPI rose by 0.8% to a level of 138.7, matching market expectations. Core PPI, which excludes prices for food and energy and is therefore considered to be less volatile, increased by 0.5% to a level of 134.5, likewise matching market forecasts. Year-over-year producer inflation eased slightly, from 10.9% to 10.7%. Core inflation followed a similar trajectory, declining from 8.7% to 8.3%.

Producer prices continued to increase last month, driven primarily — and to no one’s surprise — by food and energy costs. The latter rose 5% on the month, with gasoline prices surging 8.4%. Goods prices climbed 1.4% and the cost of services advanced 0.4%. The headline rate may appear to suggest that supplier prices are moderating, however, the monthly data tells a somewhat different story. On a monthly basis, producer inflation was higher in May than it was in April, suggesting that the apparent decline in producer prices is mainly the result of a base effect. Lower inflation rate or not, this marks the sixth consecutive month of double-digit price increases. Elevated consumer prices suggest that consumer prices could continue to see upward pressure for the next several months. That puts pressure on the Fed to tighten monetary policy more aggressively—markets certainly think they will. The current market expectation for June’s meeting is shifting towards 75 basis points, which has changed from the original Fed Forecast of 50 basis points; whether the Fed will go forward with this new expectation will be a guess until tomorrow.

June 14, 2022