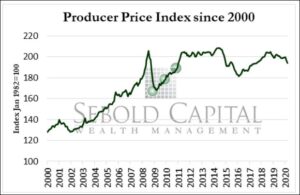

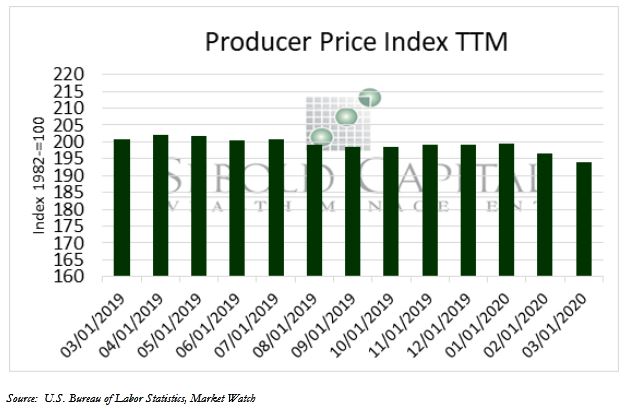

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand-intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

In March, PPI decreased by -1.37% from February’s level of 196.5 to 193.8, a -3.5% decrease from one year ago. Final demand fell by -0.2% in March, slightly better than the -0.6 decline in February. Core PPI, which excludes volatile categories like food and energy, has increased by 1.0% within the past 12 months.

The sharp monthly PPI decrease can be largely attributed to the coronavirus pandemic and oil price war, which have forced oil prices down as production has increased to make up for previously lost revenue. The coronavirus is suppressing demand for services related to transportation, entertainment & recreation, and hotel accommodation, with each sector being negatively impacted by government measures to limit the spread. Energy prices have fallen by -6.7% in the past month, specifically, being weighed down by the -16.8% drop in gasoline prices due to the price war. It is highly likely that this decline will continue into April as we will then see the full effect of the coronavirus pandemic concerning demand.

April 13, 2020