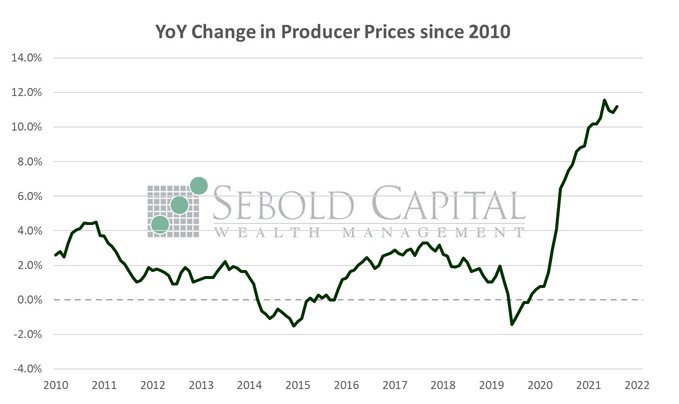

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand/intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

The Producer Price Index (PPI) looks at the average change in selling prices from the viewpoint of domestic producers of both goods and services. Three areas of production are observed: industry-based, commodity-based, and commodity-based final demand/intermediate demand. Investors look to the producer price index, which is a more relevant way of gauging inflation than the CPI because of the large basket of producers (100,000 price points) that Bureau of Labor Statistics uses as a data pool for their calculations.

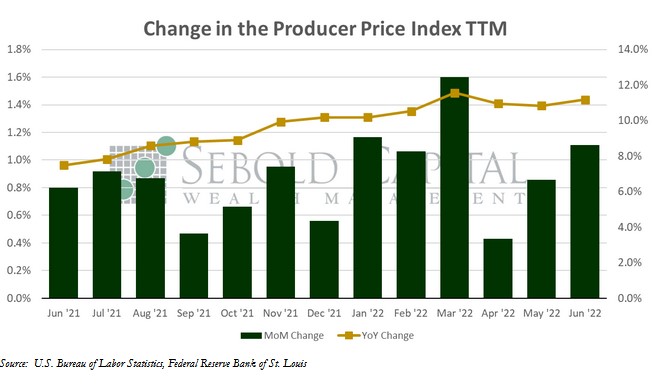

In June, the PPI rose by 1.1% to a level of 140.4, exceeding market expectations of a 0.9% advance. Core PPI, which excludes prices for food and energy and is therefore considered to be less volatile, increased by 0.4% to a level of 135.3, matching the forecast. May’s print for both headline and core CPI was upwardly revised. Year-over-year producer inflation rose from 10.9% to 11.3% after having declined for two consecutive months. However, core inflation eased from 8.5% to 8.3%, extending a four-month-long downward trajectory.

Producer prices accelerated last month, posting the seventh consecutive month of double-digit annual gains. Energy prices continued to be primary driver of inflationary pressures in the economy, from both the supply and demand sides. Unlike the CPI report that came out yesterday, the PPI showed core prices slowing down both on a monthly and annual basis, indicating that producer price inflation could ease once the recent decline in commodity prices is reflected in the data. A softening of core price pressures appears to suggest a modest improvement in supply conditions as well, with core prices for goods posting their lowest increase since December. However, the data continues to show that producer costs are rising at a historically elevated pace, even if it is being driven primarily by volatile categories like energy. Energy is an essential component of many supply-side processes, such as manufacturing and transportation. Higher costs in energy are likely to continue filtering through the value chain, creating conditions that allow inflation to remain historically high even if the underlying price pressures themselves have peaked.

July 14, 2022