Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength of U.S. Consumer spending, which accounts for roughly two-thirds of the economy. This indicator also provides insight into which areas of the retail space are experiencing strong sales.

Retail Sales are the total amount of merchandise and related services sold to consumers. It is considered a sign of strength of U.S. Consumer spending, which accounts for roughly two-thirds of the economy. This indicator also provides insight into which areas of the retail space are experiencing strong sales.

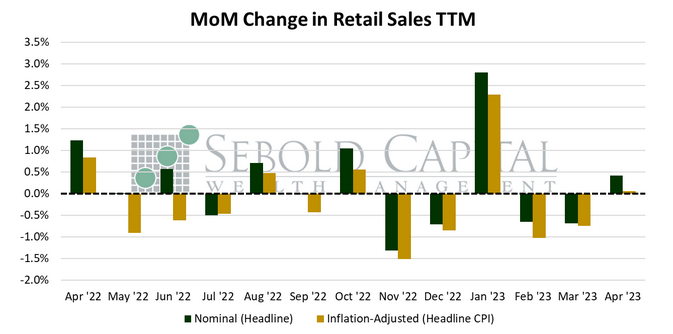

In April, retail sales rose by 0.4% to $686.1 billion, coming in below the expectation of a 0.8% increase. March’s print was revised to the downside from -0.6% to -0.7%. Excluding auto sales, retail sales increased by the same amount as the headline print of 0.4%, although these were in line with expectations. Three of the four broad categories that make up the report declined last month. Spending at bookstores declined 3.3% to $8.3 billion. Sales at electronics stores fell 0.5% to $7.66 billion. Spending on clothing and apparel was 0.3% lower than the previous month, totaling $25.5 billion. The only category to post an increase was spending at bars and restaurants, which rose 0.6% to $88.1 billion.

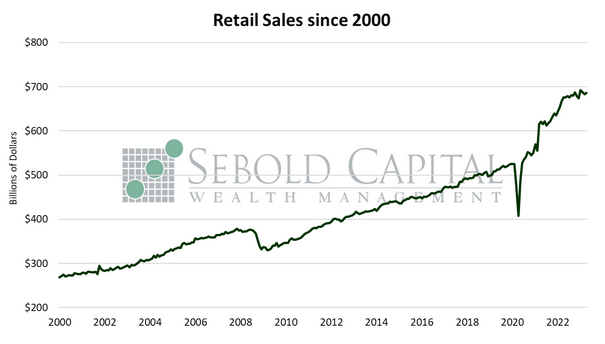

Consumer spending increased modestly at an aggregate level last month, reversing two months of declines. However, spending increased at the slowest annual pace since May 2020, rising only 1.6% from the previous year. It is important to remember that retail sales are not adjusted for inflation; in real terms, spending increased 0.1% for the month but declined 3.3% on an annual basis. Consumers spent more at car dealerships, home improvement stores, bars and restaurants, and online retailers. Spending was lower at gas stations and department stores, where it declined 1.1%. Consumers also spent less on household furnishings. It appears that consumer demand continues to moderate, no longer boasting the same strength that it had shortly after the economy reopened, but also not weakening substantially to the point of concern. It has normalized and is now consistent with pre-pandemic levels. Retail sales, along with most other economic indicators, continue to support the idea that no further rate hikes are needed, although it also provides no evidence to support any kind of easing in monetary policy either. We remain in a holding pattern for now.

May 16, 2023