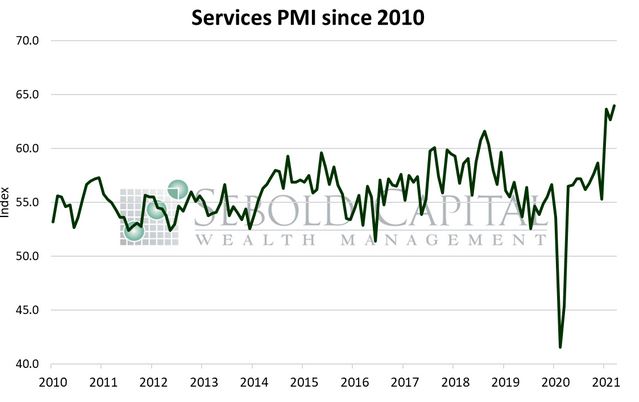

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

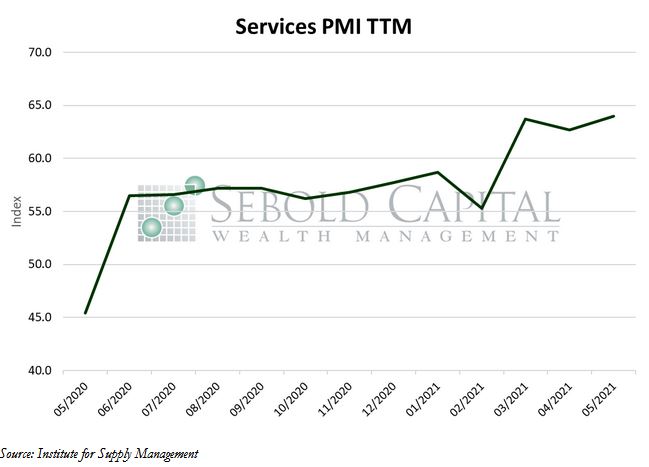

In May, the Services PMI rose by 1.3 points to a reading of 64.0. This marks one year of consecutive growth for the services sector and the economy as a whole. All of the eighteen industries that make up the index reported growth, with most businesses reporting a strong rate of expansion and an increased production capacity.

The index is made up of ten different sub-indexes which measure different aspects of the services sector. Seven of these sub-indexes rose last month, while two of them declined. Business activity and production expanded at a faster rate last month, with new orders, new export orders, and inventories all increasing according to their respective sub-indexes. However, employment in the services sector grew at a slower rate in May, as many businesses still report difficulties finding and retaining workers. Another ongoing concern for businesses is the rapid rise in prices resulting from inflationary pressures in the economy. The sub-index that measures prices surged by 3.8 points to a new cyclical high of 80.6, further casting doubt on the whole “it’s transitory” narrative. Many businesses have already received higher wholesale prices, and they will likely continue to pass those higher costs onto their consumers. Despite the setbacks, businesses in the services sector report rising revenues and strong consumer demand, meaning that the economy largely continues to move in the right direction.

June 3, 2021