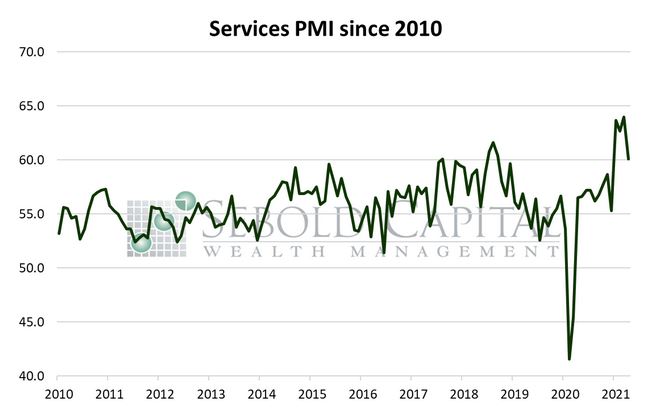

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

The ISM Services Purchasing Managers Index (PMI) helps determine the overall economic strength of the services sector. Components evaluated are employment, business activity, new orders, and supplier deliveries, which are then compiled into an index. The services sector represents a much larger share of the overall U.S. economy when compared to the manufacturing sector, making up approximately 80% of it; the sector’s economic weight makes it an important sign of growth, stagnation, or contraction. Readings above 50.0 indicate expansion while readings below 50.0 signal decline.

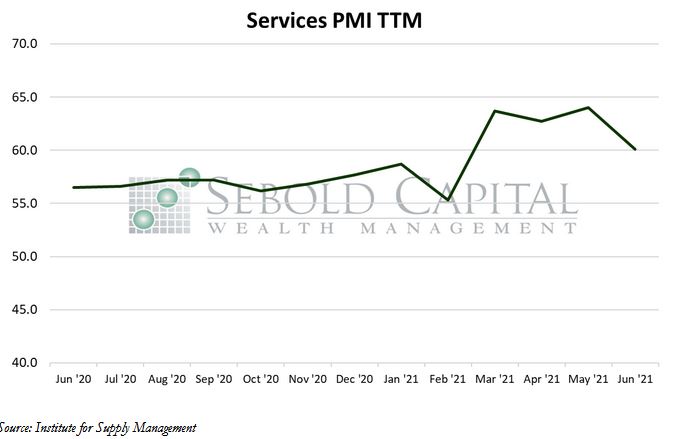

In June, the Services PMI declined by 3.9 points to a reading of 60.1, falling short of market estimates of 63.5. Despite the pullback, this marks the thirteenth consecutive month of expansion for the services sector and for the overall economy. Sixteen out of the eighteen industries that make up the index reported growth last month, with real estate and agriculture reporting contractions.

The index is made up of ten different sub-indexes which measure different aspects of the services sector. All but two of these sub-indexes declined last month. Businesses continue to face challenges which include material shortages, rapidly rising prices, difficulties attracting and retaining workers, and issues with logistics. The employment sub-index slid back into contraction territory, just as it did in the Manufacturing PMI report that was released last week. Businesses have been finding it quite challenging to fill open positions for a number of months, which is reducing the ability to meet the surge in consumer demand stemming from the re-opening of the economy. The sub-index that measures prices saw a slight decline in June from 80.6 to 79.5 but remains firmly in expansion territory, meaning that prices continued to increase. Year-to-date, prices for the services sector have soared by 23.8%, and if the sub-index’s movements for the past six months are annualized, prices will have increased 48.7% in 2021. Overall, businesses report a rapid increase in activity and consumer demand, however, the labor shortage, rising prices, and supply chain issues could put a damper on an otherwise growth-centric business condition.

July 6, 2021