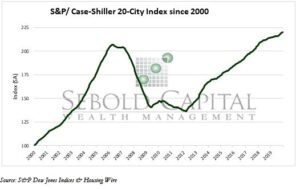

The 20-city S&P/Case-Shiller index is a measure of existing home values across 20 metropolitan areas throughout the U.S. By comparing single family home prices in each district to the similar home prices over time, the index tracks how property values increase or decrease. Home values have a broad, significant impact on the economy, including the housing and consumer sectors.

The 20-city S&P/Case-Shiller index is a measure of existing home values across 20 metropolitan areas throughout the U.S. By comparing single family home prices in each district to the similar home prices over time, the index tracks how property values increase or decrease. Home values have a broad, significant impact on the economy, including the housing and consumer sectors.

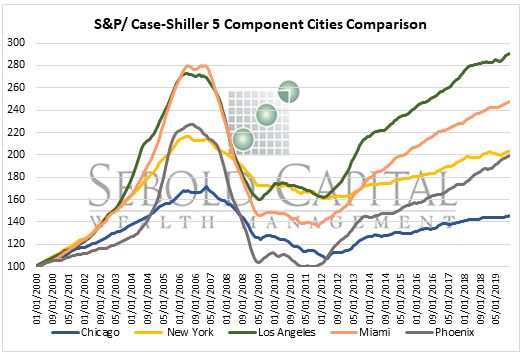

The 20-city Case-Shiller Index has grown by 2.8% over the past twelve months. Much of this recent growth occurred between July and December with a total increase of 1.9% after remaining relatively constant with an average monthly increase of 0.12% from April to June. Home prices in Phoenix and Charlotte are leading with a yearly increase of 5.9% and 5.2%. The U.S. National Home Price Index shows that the year-over-year single-family home prices are up by 3.7% from 2019 to 2020.

The Case-Shiller index is an indication as to how individual homeowners consider their investment in their house in terms of the home’s value; as a result, the index can also be used to infer how homeowners’ spending will be affected in response to their home’s value. The recent uptick in rising home prices could be due to the decrease of housing inventories, especially in places such as Charlotte, Miami, and Phoenix, fewer homes on the market drive up the price of existing homes. Rising home prices might encourage people looking for a house and investors to buy a house now, as to avoid even higher prices in the future. However, in some cities such as Chicago, growth has slowed and leveled off as buyers pull back and demand lessens due to factors such as slow employment growth and increasingly high taxes. This uptick in the Case-Shiller 20-City Index shows a positive change for investors as housing equity inches slightly closer to recovering previous 2008 values in most cities.

March 4, 2020