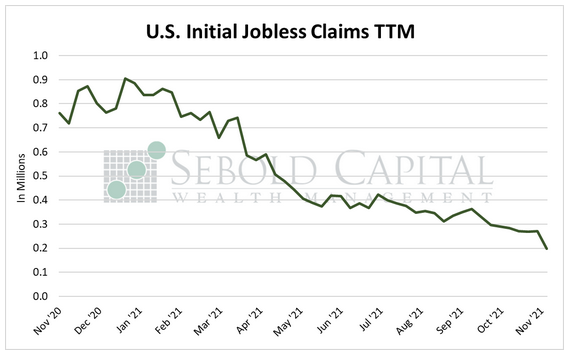

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week. One can gauge market conditions in the US economy around employment; as more new individuals file for unemployment benefits, fewer individuals in the economy have jobs. In normal times, this means people have less money to spend. Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods, such as on March 21, 2009, when 661,000 new filings were reported.

US Initial Jobless Claims, provided by the US Department of Labor, provides underlying data on how many new people have filed for unemployment benefits in the previous week. One can gauge market conditions in the US economy around employment; as more new individuals file for unemployment benefits, fewer individuals in the economy have jobs. In normal times, this means people have less money to spend. Historically, initial jobless claims tended to reach peaks towards the end of recessionary periods, such as on March 21, 2009, when 661,000 new filings were reported.

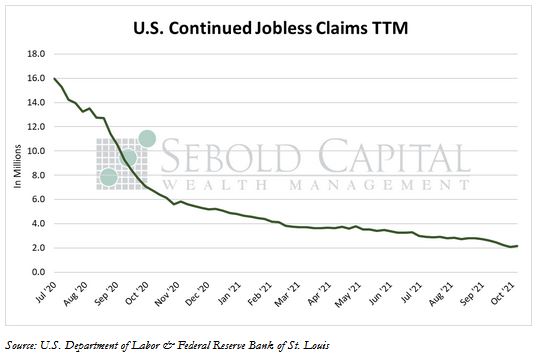

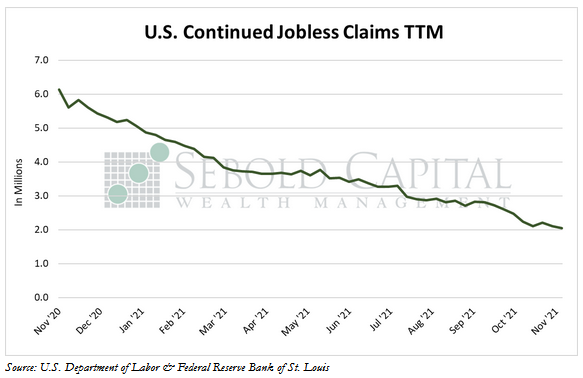

Last week, initial claims sharply declined by 26.03% to 199,000—not only hitting their lowest point since the start of the pandemic but also reaching a 52-year low. Continued claims likewise declined, although by a far less dramatic 2.84%, and they now stand at 2.05 million—also a pandemic-low. Both initial and continued claims are now well below their respective long-run averages of 371,000 and 2.81 million.

Initial claims fell to their lowest point since November of 1969, continuing to reflect the fact that businesses are determined to hold on to their employees. The figure, which serves as a proxy for layoffs, has fallen at a rapid pace as the labor market has tightened and the shortage of workers has intensified. Continued claims have also seen a significant decline, although they remain above their pre-pandemic level. The figure has been declining at a slightly faster rate since the enhanced unemployment benefits expired at a nationwide level in early September. Now that the disincentive to work has been reduced, the labor shortage should continue to ease and whatever staffing challenges remain will likely be attributable to structural factors, such as a large number of older workers choosing to leave the workforce and opting for early retirement.

November 24, 2021