Health Insurance can feel like a puzzle, where we can eyeball a part, but we won’t know if it’s correct until the pieces around it are found. In a sense, Medicare exists to help eliminate the puzzle aspect. However, the process of starting Medicare can be equally confounding. One of the most critical questions is, when do I sign up for Medicare? For some, the answer is easy; for most, it’s probably not. This article will outline the decision-making process on when to apply and sign up for Medicare.

I am no longer working.

If you do not have any creditable employer coverage, sign up for Medicare three months before age 65. This time frame will ensure there are no gaps in coverage when switching from market insurance to Medicare. Make sure to stop any HSA contributions to avoid tax penalties.

I am currently working and have employer coverage.

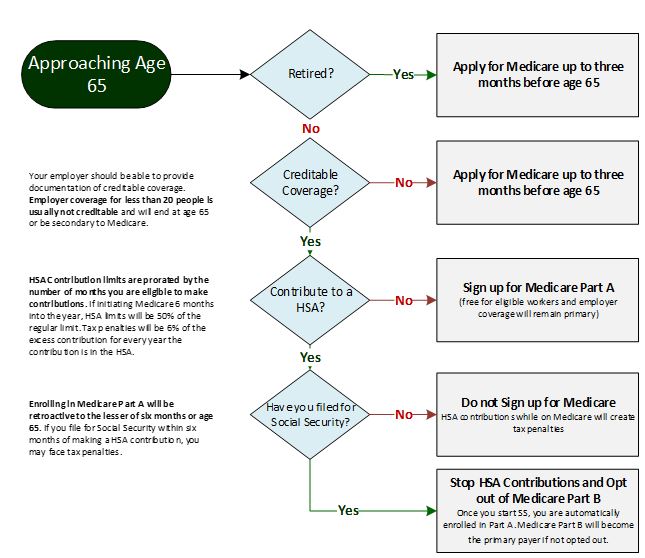

Working past 65 is where signing up for Medicare gets tricky. There are multiple items to consider and potential penalties for delaying Part B Coverage without creditable coverage. Below is a flow chart to guide the Medicare start date conversation. The primary item to consider is if the current employer policy is creditable coverage. Other items include HSA contributions and filing for Social Security.

It is essential to get this timing right because the Medicare Part B late enrollment cost is a 10% increase in premium for every 12 months you should have been on Medicare. This penalty will be applied to Medicare Part B premiums every year you are on Medicare. Enrolling during the Special Enrollment Period bypasses the penalty.

Key Notes

The Medicare enrollment window is three months before turning 65 through three months after. Including the month turning 65, it is a 7-month window. If you continue to work past 65 with creditable coverage, the Special Enrollment Period begins the month after employment, or the creditable coverage ends. The Special Enrollment Period is extended by one month to 8 months total. COBRA coverage and retiree health plans are not considered creditable coverage based on current employment.

The correct timing of Medicare can be a complicated and costly decision. However, this is a rare financial decision that has explicit right and wrong answers. If you would like additional information or assistance regarding your Medicare Decision, please reach out to Sebold Capital Management.